CURRICULUM

The US CPA licensure model requires all candidates to pass three Core exam sections and one Discipline exam section of a candidate’s choosing. The Uniform US CPA Examination (the Exam) has been designed accordingly as reflected in the Exam Blueprints. The Core exam sections assess the knowledge and skills that all newly licensed US CPAs (lCPAs) need in their role to protect the public interest. The Discipline exam sections assess the knowledge and skills in the respective Discipline domain applicable to lCPAs in their role to protect the public interest.

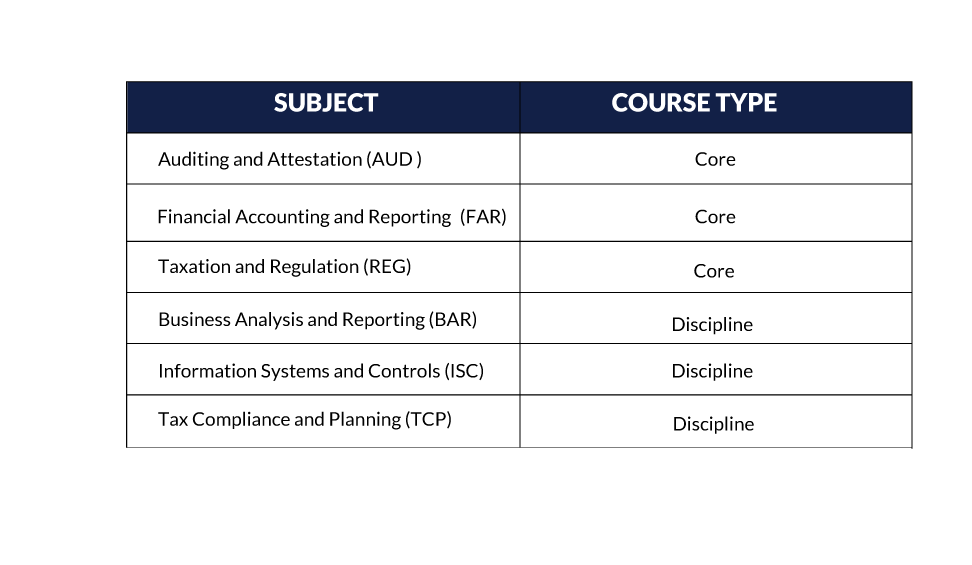

The three Core exam sections, each four hours long, are: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR) and Taxation and Regulation (REG).

The three Discipline exam sections, each four hours long, are: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC) and Tax Compliance and Planning (TCP).

The table below presents the design of the Exam by Core and Discipline section, section time and question type.