CFA Scholarship Quiz

Enter Your Details

Lets Start The Quiz

Question 1:

For which of the following assets is it most appropriate to test for impairment at least annually?

A patent with a legal life of 20 years

A trademark with an indefinite expected life

Question 2:

Which of the following conditions is most likely associated with decreased earn¬ings quality? Compared with the prior year, the reporting entity’s earnings:

Were similar in magnitude but included a large gain on the sale of a manu¬facturing plant.

Increased slightly because of a reduction in bad debt expense based on more-current experiences.

Question 3:

An investor has gathered the following data for a common sock:

| Earnings per share, 2013 | $20.50 |

| Dividend payout ratio, 2013 | 60% |

| Dividend growth rate expected during 2014 and 2015 | 25% |

| Dividend growth rate expected after 2015 | 5% |

| Investor's required rate of return | 12% |

Using the two stage dividend discount model, the value per share of this common stock this is closed to:

$38.70

$31.57

$28.57

Question 4:

An inventory system that reduces average inventory without affecting sales will most likely reduce the:

Inventory turnover

Cash conversion cycle

Question 5:

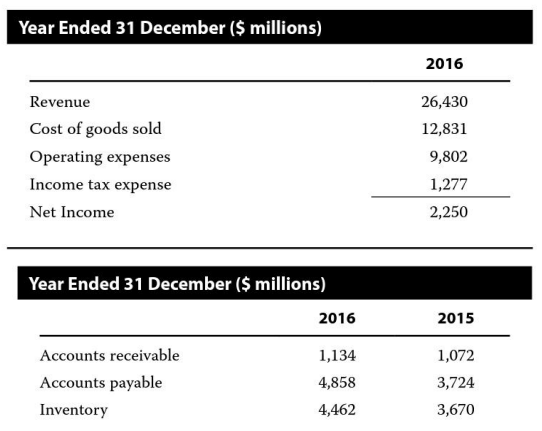

An analyst gathers the following information from a company's current financials statements:

If the company uses the direct method to prepare its cash flow statement, the cash received from customers (in $ millions) will be closest to:

26,36825,296

26,492

Last Date of Submission is 3rd OCT